“We evaluated all the available automation software and selected VantedgeAI because there is nobody else in the market offering an end-to-end solution tailored to private credit”

- Head, Private Credit

A Specialist Asset Management Firm (AUM $5Bn)

“I can instantly review all IG issuers on my radar, extract key signals, and update my positioning without waiting for analysts to compile summaries. It gives me speed and clarity when timing matters most.”

- Portfolio Manager

Investment Grade Credit, Large Institutional Fund

“VantedgeAI ensures consistency in our research process, automates data collection, and flags credit deterioration before it shows up in market pricing. It's become integral to how we screen deals, manage risk and coverage.”

- Head of EM Credit Research

Multi-Strategy Fund

“Integrating VantedgeAI with our internal systems gave our real-time visibility into loan portfolio risks. It identifies covenant issues, and helps us validate analyst assessments. It's a huge leap in proactive monitoring.”

- Senior Risk Manager

Leveraged Finance Group, Mid-sized Bank

“VantedeAI has helped us scale CLO modeling and issuer tracking. It parses trustee reports, consolidates asset-level commentary, and enables my team to react faster to asset deterioration or manager behavior. It's become a foundational tool in our structured credit operations.”

- Head of Structured Credit

Asset Manager

“VantedgeAI transformed the way I handle credit memo preparation. What used to take me an entire day now takes minutes. I can pull structured summaries, risk flags, and peer comps instantly. It's like having a junior analyst on-demand — but 10x faster.”

- Sr. Credit Analyst

Global HY Desk, Tier 1 Asset Manager

“We evaluated all the available automation software and selected VantedgeAI because there is nobody else in the market offering an end-to-end solution tailored to private credit”

- Head, Private Credit

A Specialist Asset Management Firm (AUM $5Bn)

“I can instantly review all IG issuers on my radar, extract key signals, and update my positioning without waiting for analysts to compile summaries. It gives me speed and clarity when timing matters most.”

- Portfolio Manager

Investment Grade Credit, Large Institutional Fund

“VantedgeAI ensures consistency in our research process, automates data collection, and flags credit deterioration before it shows up in market pricing. It's become integral to how we screen deals, manage risk and coverage.”

- Head of EM Credit Research

Multi-Strategy Fund

“Integrating VantedgeAI with our internal systems gave our real-time visibility into loan portfolio risks. It identifies covenant issues, and helps us validate analyst assessments. It's a huge leap in proactive monitoring.”

- Senior Risk Manager

Leveraged Finance Group, Mid-sized Bank

“VantedeAI has helped us scale CLO modeling and issuer tracking. It parses trustee reports, consolidates asset-level commentary, and enables my team to react faster to asset deterioration or manager behavior. It's become a foundational tool in our structured credit operations.”

- Head of Structured Credit

Asset Manager

“VantedgeAI transformed the way I handle credit memo preparation. What used to take me an entire day now takes minutes. I can pull structured summaries, risk flags, and peer comps instantly. It's like having a junior analyst on-demand — but 10x faster.”

- Sr. Credit Analyst

Global HY Desk, Tier 1 Asset Manager

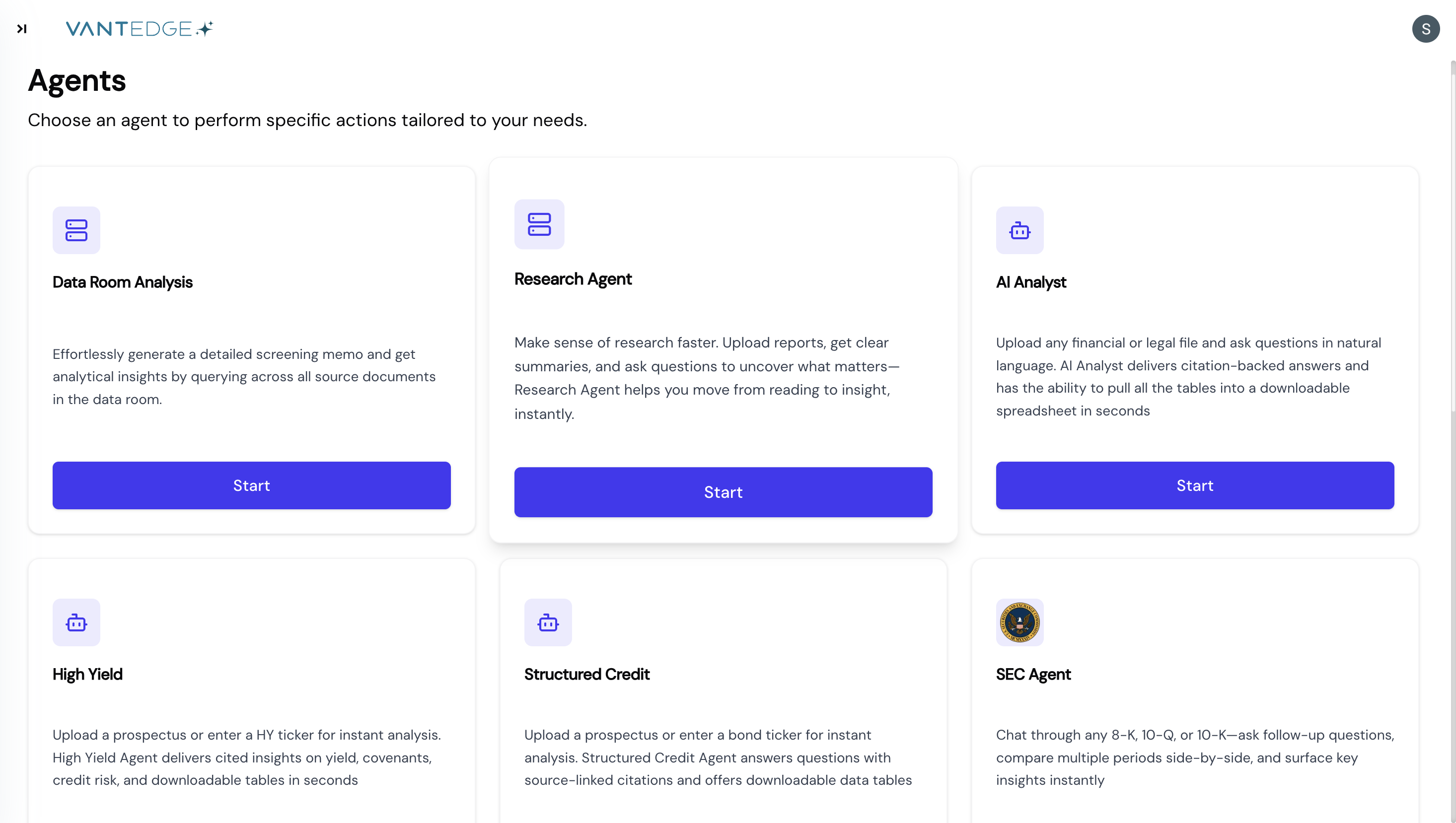

Single Interface

One unified dashboard. Many agents. A seamless experience from upload to output.

Evolving Ecosystem

New agents are continuously deployed - making your platform smarter every month.

Curated Partnerships

We integrate with hand-picked third-party agents that complement your credit workflow.

Hyper-Specialized Intelligence

Each agent is trained to master one task - from valuation to risk flagging to Excel generation.

Data Room Analysis

Research Agent

AI Analyst

High Yield

Structured Credit

8K, 10Q & 10K

TableXtract AI

AutoModel

Valuation Agent

YC Screening Memos

Data Room Analysis

Research Agent

AI Analyst

High Yield

Structured Credit

8K, 10Q & 10K

TableXtract AI

AutoModel

Valuation Agent

YC Screening Memos